News & Trends

Stay up to date with the latest developments, insights, and trends in the wealth and asset management industry. Read our latest blog posts, company updates, and industry news to learn how we are driving innovation and creating value for our clients.

News

Award-Winning International Marketing Campaign & Team

Yesterday evening in Geneva, we were recognized with the WealthBriefing Swiss Award 2026 in the category International Marketing Campaign & Team. This recognition marks an important milestone for us, as it reflects a year of...

News

Etops Announces Aike Festini as New Group Chief Operating Officer

Etops has announced the appointment of Aike Festini as Group Chief Operating Officer (Group COO), strengthening the company’s operational leadership at a pivotal stage of its growth and integration journey.

Product

GTRegs: Grant Thronton Regulatory Monitoring Tool powered by Etops

Grant Thornton has launched a new regulatory monitoring tool in collaboration with Etops. GTRegs is a digital solution designed to help financial institutions keep pace with regulatory developments in the Swiss financial market. With Grant...

News

Etops Announces Patrick Kopp as New Group Chief Services Officer

Etops has announced the appointment of Patrick Kopp as Chief Services Officer (CSO). After nearly nine years within the Etops Group, where he has contributed to the development of consulting, data, and risk services. His...

Product

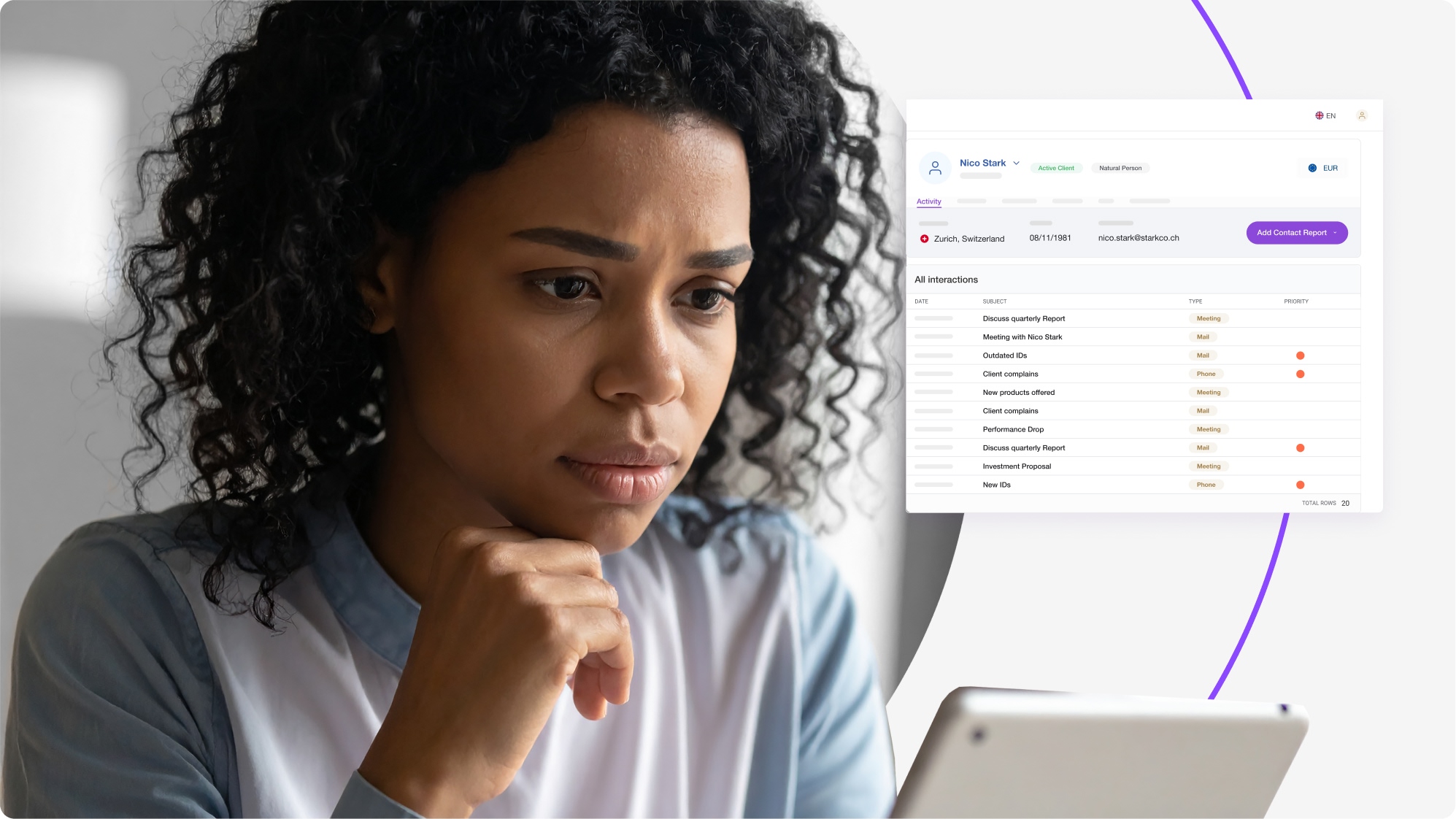

Advisor Intelligence: Turning Advisory Conversations into Actionable Insights

Advisory conversations are the heart of every financial and insurance consultation. They are where goals are defined, risks evaluated, decisions prepared, and trust established. At the same time, these conversations face growing regulatory demands from...

Industry Insights

Generic Tools Are Putting Family Wealth at Risk

Managing wealth across generations is complex. Today’s family offices often oversee portfolios that span continents, currencies, and asset classes, from real estate in Europe to venture capital in Asia and private equity in North America....

Industry Insights

Poor Data Governance Is Costing You Returns

In wealth and asset management, performance isn’t just about picking the right investments. It’s about making the right decisions, and those decisions depend on data. If your data governance is weak, you’re leaving money on...

News

Etops 2025 Year in Review: A Year of Growth and Innovation

2025 has been a milestone year for Etops. From launching our new brand to expanding our product ecosystem and welcoming new clients, here’s a quick look back at what made this year special.

Industry Insights

Data Management: From Burden to Automation

In institutional asset management, data management is often seen as a necessary obligation rather than a strategic advantage. Regulatory requirements, reporting standards, and operational needs make it unavoidable, but rarely exciting. This perception drives a...

News

Etops featured in Simple’s Software & Technology Report

The family office world is changing fast. Technology is no longer a nice-to-have, it’s becoming the backbone of operations. Simple’s Family Office Software & Technology Report 2025 captures this shift perfectly, offering a deep dive...

Industry Insights

Preparing for the Great Wealth Transfer

The largest handover of wealth in modern history is already underway. Over the next 20 years, trillions will move from older generations to their heirs: reshaping the way wealth managers, private banks, and family offices...

Industry Insights

Outsource or Build Your Asset Management Tech?

Every asset manager eventually faces the same question: should we build our own software, or adopt an outsourced solution? On paper, building sounds appealing: full control, tailored to your needs, easy scalability and potentially a...

Industry Insights

Tech for IFAs: Why Digital Transformation Can’t Wait

Independent Financial Advisors (IFAs) in Europe are under pressure. Clients expect real-time access and personalized service, while regulations like MiFID II, WpHG, SFDR, and FIDLEG keep getting tougher. At the same time, operational costs are...

Industry Insights

Financial Interoperability: The Foundation for Growth

In today’s wealth management landscape, clients expect more than just performance, they expect clarity, consistency, and control. But delivering that experience is harder than it looks. Data is scattered across custodians, systems don’t talk to...

Industry Insights

Driving Portfolio Success with Quality Data

In wealth management, data is more than a resource, it’s a strategic advantage. The ability to make informed decisions, deliver personalized advice, and maintain regulatory compliance depends on the integrity and completeness of the data...

Industry Insights

Europe’s Asset Management: Agility & Clarity

Europe’s asset management sector in 2025 is undergoing a profound transformation. At Etops, we believe that data-driven technology, actionable insights, and true partnership empower firms not merely to survive this disruption but to lead it....

Industry Insights

Reporting as a Strategic Lever for Asset Managers

In today’s asset management landscape, client reporting has evolved from a routine operational task into a strategic lever. Institutional clients are no longer satisfied with static quarterly PDFs: they expect transparency, customization, and immediacy. For...

Industry Insights

Strategic Automation: The Path to Radical Efficiency

European asset managers are facing unprecedented margin pressure and operational complexity. But while some firms struggle, others are discovering a path to "radical efficiency" through strategic automation. The results speak for themselves.

Industry Insights

The Value of the Human Advisor in a Digital World

Digital tools transformed wealth management. Onboarding is faster. Reporting is automated. Data is everywhere. But here's what's happening: clients want real conversations. They want to feel understood. They want their advisor present, not just available.

News

Etops Announces Andrea Bosetti as New Group Chief Financial Officer

Etops Strengthens Executive Leadership with Appointment of Andrea Bosetti as Group Chief Financial Officer. A seasoned finance executive who brings over 25 years of experience in wealth management technology and financial services.

Industry Insights

The Democratization of the Family Office: A Quiet Tech Revolution in Wealth Management

For decades, family office services were the exclusive domain of the ultra-wealthy. Typically starting around €100 to €250 million in assets, making them largely inaccessible to most investors. But that era is quietly fading. Today,...

Industry Insights

Transparency and Risk: The New Imperatives for Wealth & Asset Managers

The investment management industry is transforming rapidly. Transparency has evolved from regulatory requirement to competitive advantage as informed clients demand real-time, actionable insights from their advisors.

Industry Insights

How AI Is Really Changing the Day-to-Day of Wealth Managers

AI in wealth management has moved beyond the hype to solve real operational challenges. From automated compliance monitoring to AI-powered client meeting preparation, firms are gaining measurable efficiency gains.

News

Finanzportal24 becomes part of Etops and strengthens the group’s offering in financial planning software

Etops expands its service portfolio with the acquisition of Finanzportal24, a leading provider of financial planning software in Germany.

News

Award-Winning Client Investment Application: Creating Meaningful Digital Experiences in Wealth and Asset Management

Etops was recently honored as the winner of the “Best Client Investment Application” at the WealthBriefing European Awards 2025. This recognition highlights our commitment to redefining wealth and asset management through data-driven products that leverage...

Industry Insights

From Regulation to Reputation: The Deeper Impact of MiFID II

In today’s financial services landscape, trust is built not only on market performance and personalized advice, but also on transparency and adherence to regulatory standards. One of the most important guidelines in this regard is...

News

The next milestone in forming the European WealthTech Powerhouse: Etops’ and niiio finance group’s client businesses align under the Etops brand

Etops Group AG and niiio finance group AG, two leading names in the European WealthTech industry, proudly announce a further milestone on their strategic roadmap. As part of their transformative move, the key business units...

Industry Insights

Safeguarding Client Trust: How Etops Integrates Cybersecurity Best Practices in Wealth Management

In the world of wealth and asset management, the importance of cybersecurity cannot be overstated. The digital age has brought immense convenience and efficiency, but it has also introduced new risks to clients' sensitive financial...

Industry Insights

Money, Mind Games, and Mastering the Market: How Behavioral Finance is Changing Wealth Management

In the world of wealth management, we've long assumed that investors are rational beings, always making decisions based on cold, hard facts. But let's face it — we're human. And humans, as it turns out,...

News

The Digital Revolution in Wealth Management: Transforming Client Service and Operations

Digital platforms have become indispensable tools for wealth managers. These innovative solutions are reshaping how to engage with clients, streamline operations, and refine investment strategies. Let's explore the profound impact of digital transformation on this...

News

Etops Group AG to become part of a European wealthtech group backed by Pollen Street Capital

Etops Group AG (Etops), a leading provider of SaaS solutions for wealth and asset management, announces that it will become part of a group consolidating the European wealth and asset management software market.

News

Is your legacy platform keeping you behind? Innovate and deliver client value with the APIs of etopsOS

Today’s finance and wealth management firms face an increasing demand for seamless integration, efficiency, and digitalization in their service offerings. Often, firms struggle with legacy platforms and complex system integrations that make backend services hard...

News

Selli AG joins the Etops Group

Etops proudly announces its merger with Selli AG, an innovative Sales Intelligence firm. This strategic partnership deepened their successful collaboration over recent years, bringing Selli AG under the Etops Group umbrella.

News

Axeed is Now Etops

Axeed has officially merged with Etops, unifying our teams and enhancing our service offerings. This transition ensures streamlined services and innovative solutions for our clients and partners. We appreciate your support and look forward to...

Product

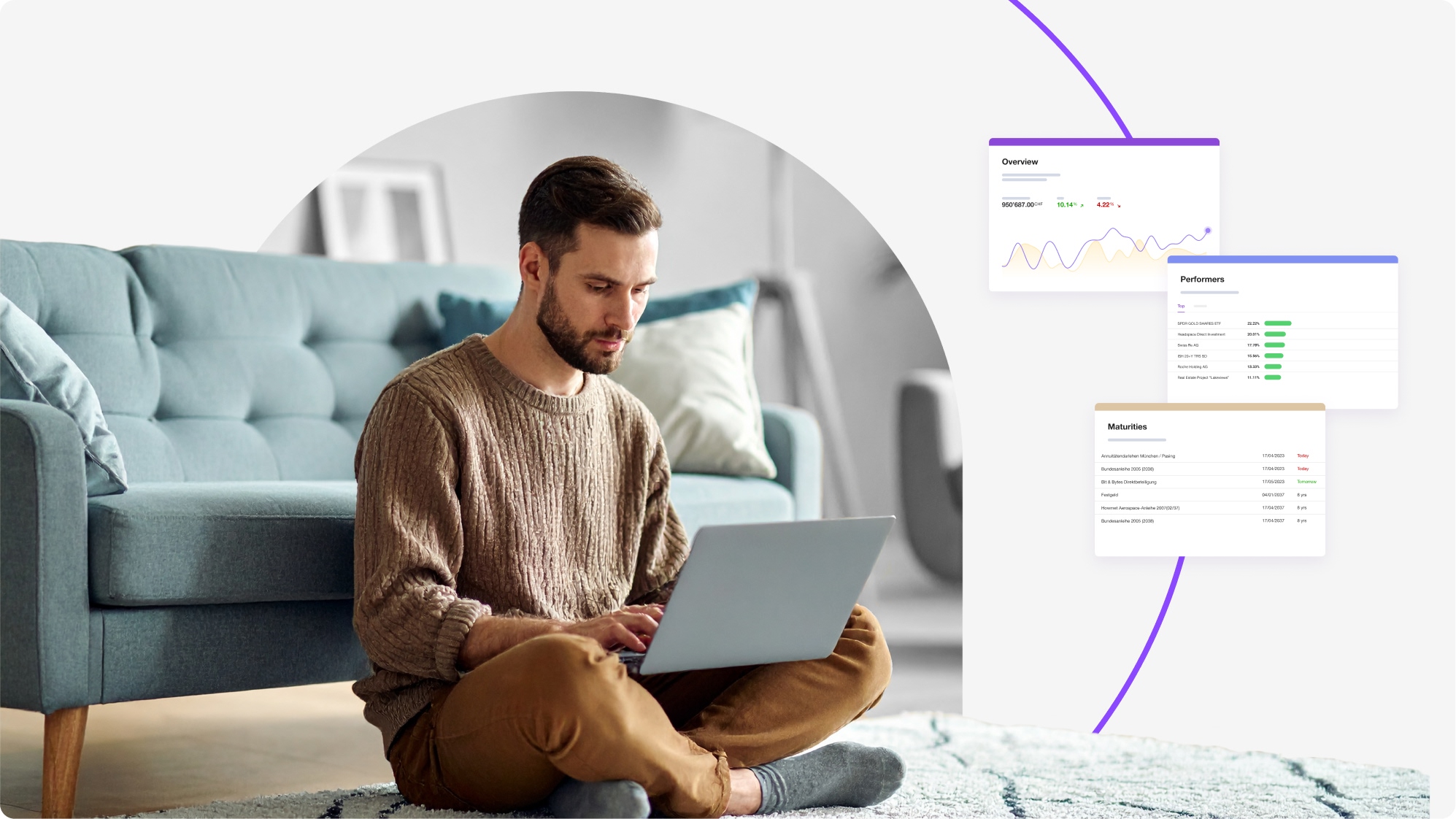

Elevate your Client Experience with Wealth Discovery

For wealth and asset managers, providing superior experiences is paramount. Your clients have high expectations when it comes to the tools and technologies you leverage to manage their portfolios and financial lives. In this modern...

Industry Insights

Empowering Wealth Managers: Essential Tools for Modern Financial Advisors

As the financial landscape evolves, the tools and technologies that empower wealth managers to navigate and excel in their roles must evolve as well. In today's fast-paced world, staying ahead requires not just expertise, but...

Industry Insights

Embracing Change: Understanding FINMA’s New Behavioral Duties according to FIDLEG/FIDLEV

In the ever-evolving wealth management industry, regulatory changes play an important role in shaping practices and standards. Recently, the Swiss Financial Market Supervisory Authority (FINMA) announced significant updates regarding behavioral duties applicable to investment advisory...

Product

Introducing Etops Fee Management and Invoicing: Simplifying Wealth Management

Efficient fee management is crucial for wealth managers, family offices, and asset managers. With Etops fee management and invoicing features, you can streamline billing processes, enhance transparency, and optimize client trust. You can easily manage,...

Partner Spotlight

Etops and Yainvest Announce Partnership to increase Trust and Transparency through Improved Risk Profiles

Etops, a leading financial services provider, and Yainvest, a third-generation behavioural finance profiling and risk engine, are excited to announce their strategic partnership aimed at redefining the landscape of wealth management services.

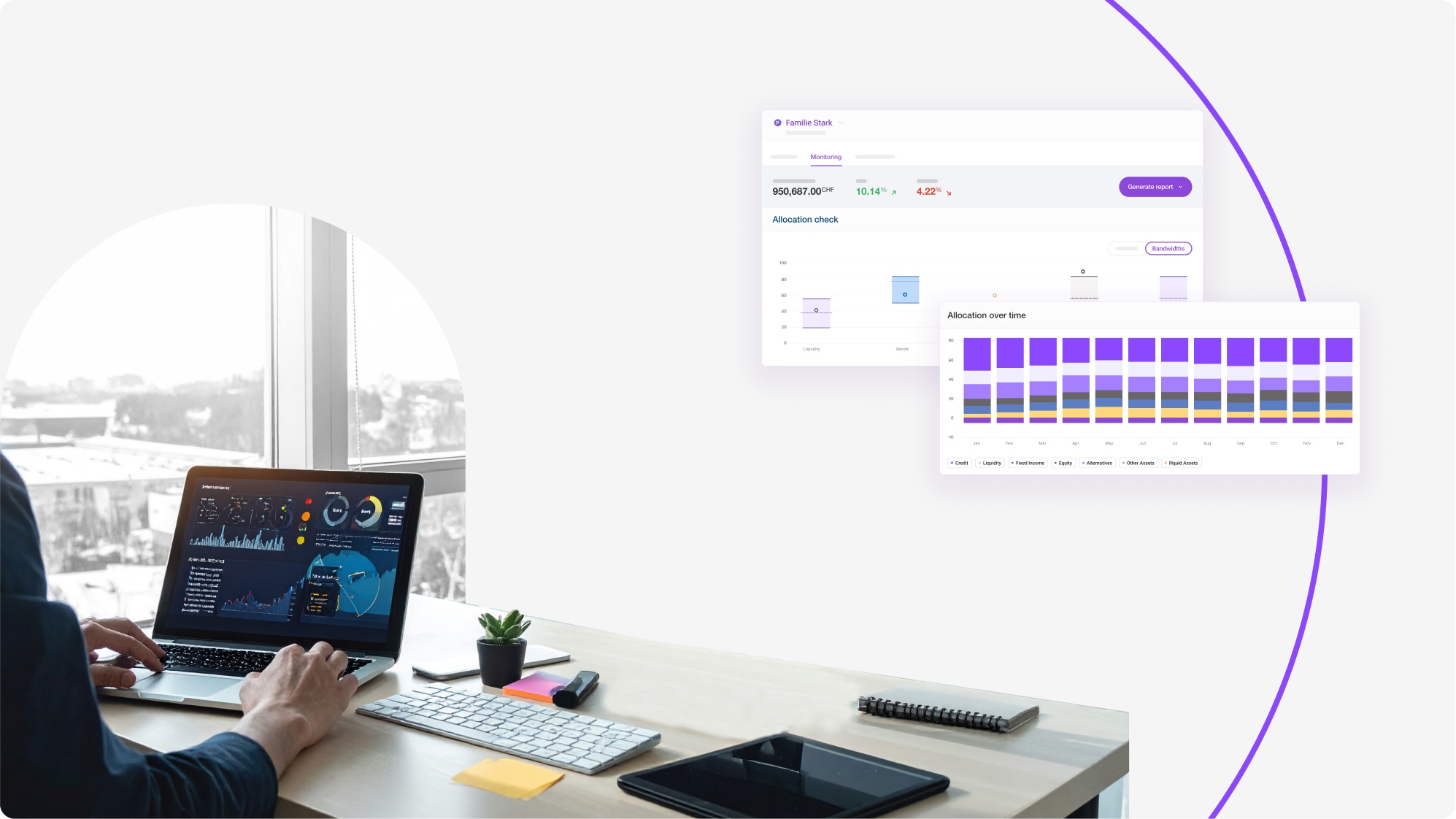

Industry Insights

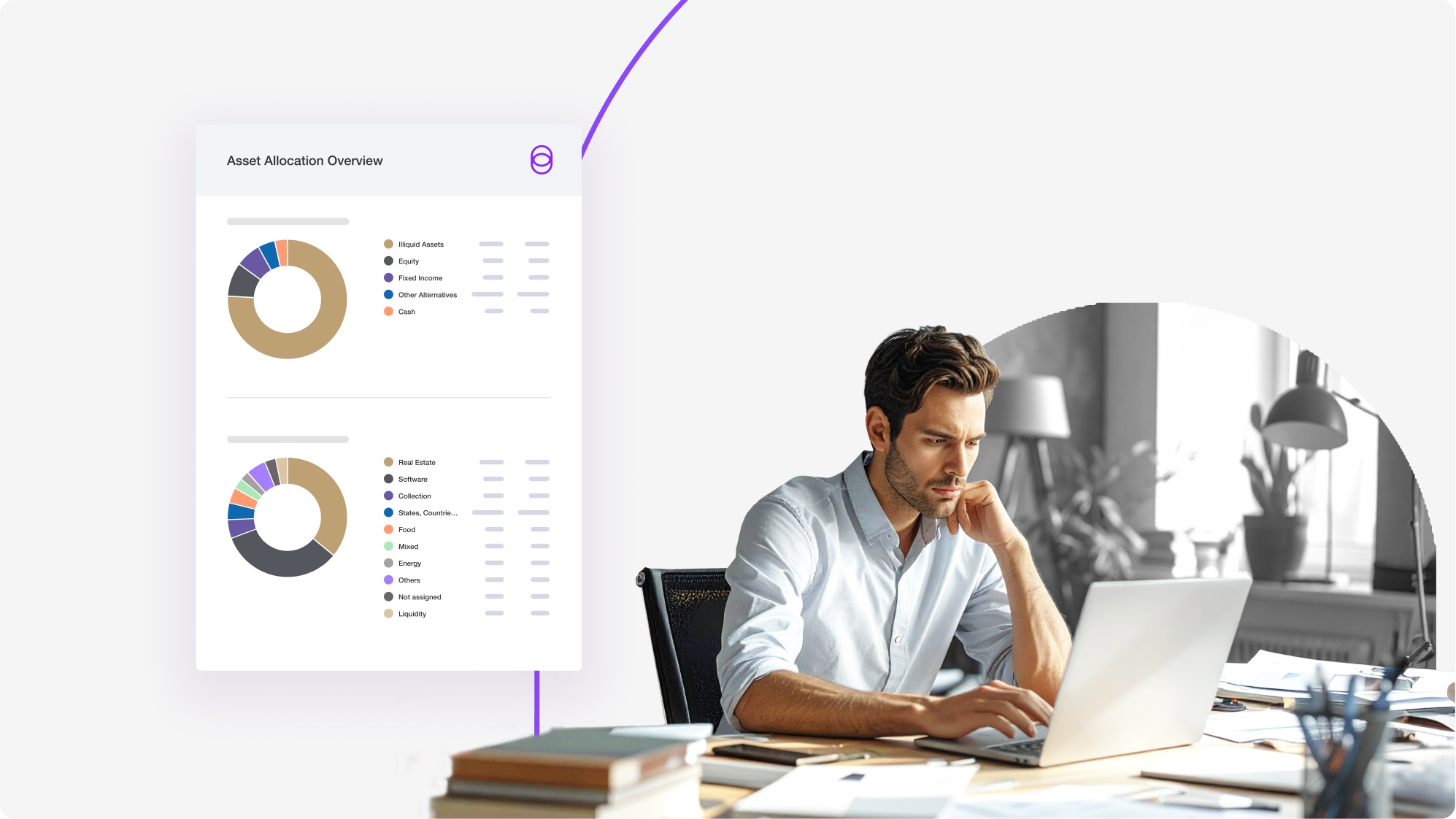

Achieving Efficiency and Transparency in Wealth Management

Discover how Etops revolutionizes wealth management for family offices by seamlessly integrating liquid and illiquid assets into a comprehensive platform. By providing efficient tools for consolidated reporting, transparent portfolio insights, and advanced analytics, Etops empowers...

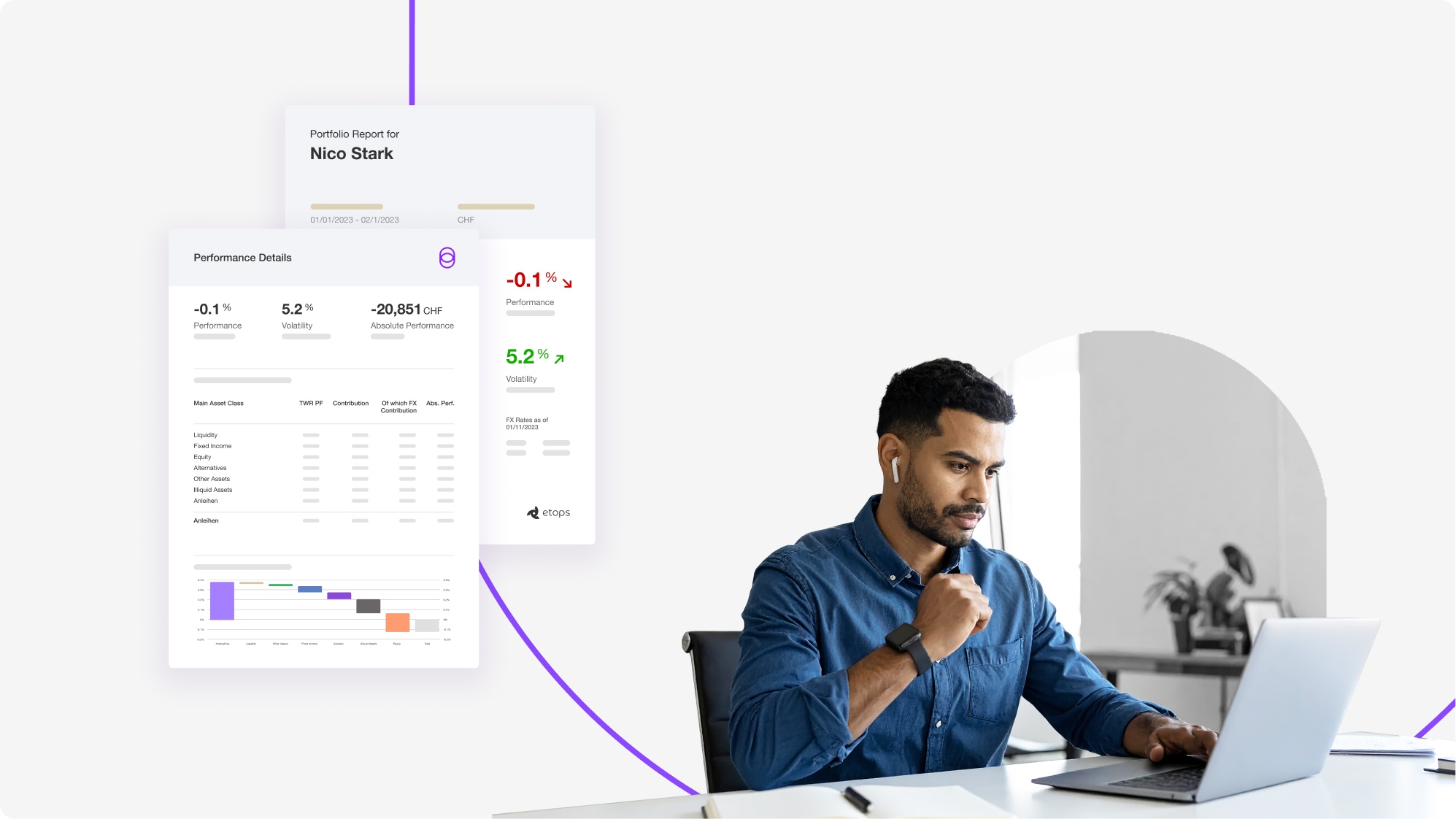

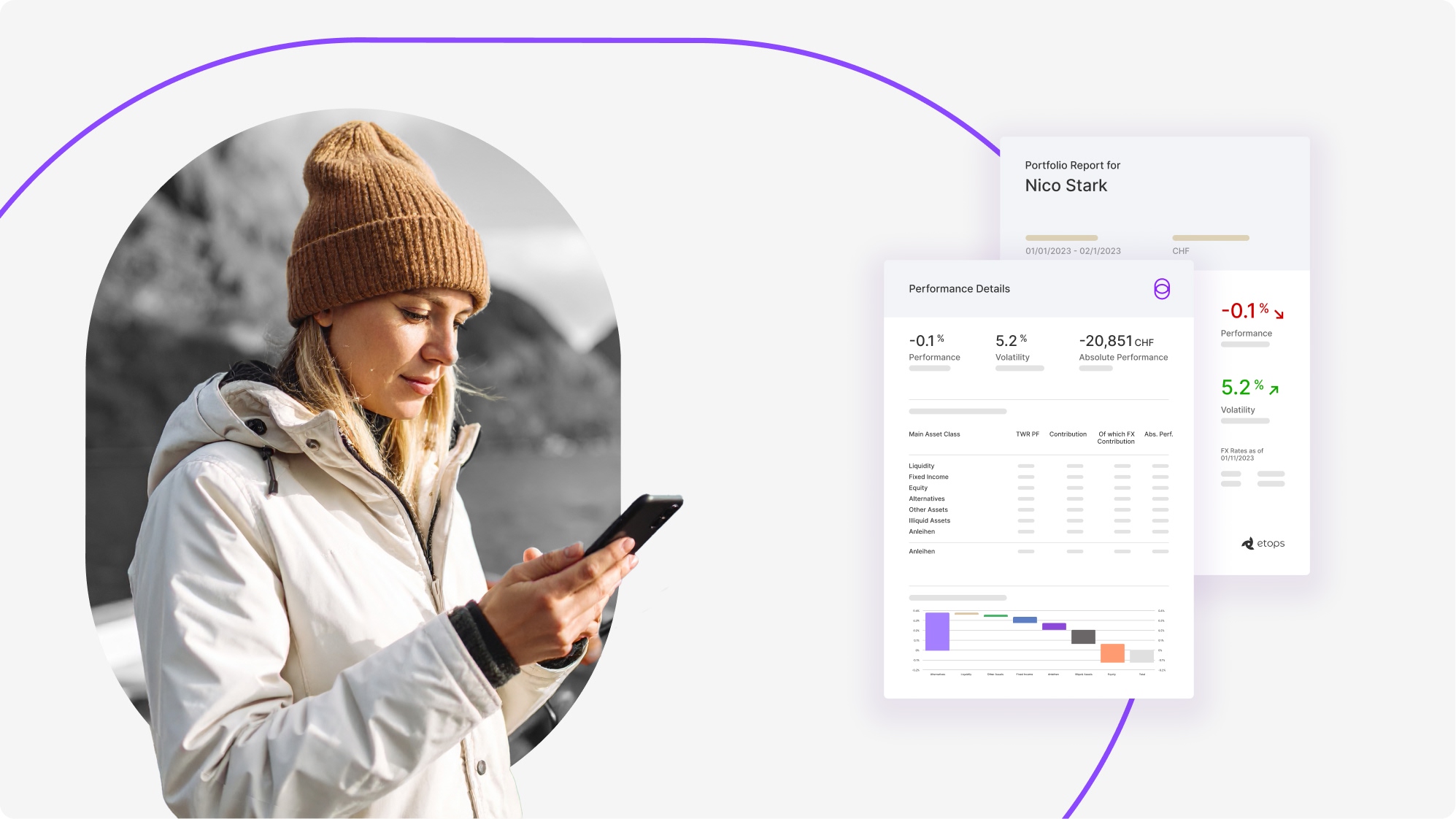

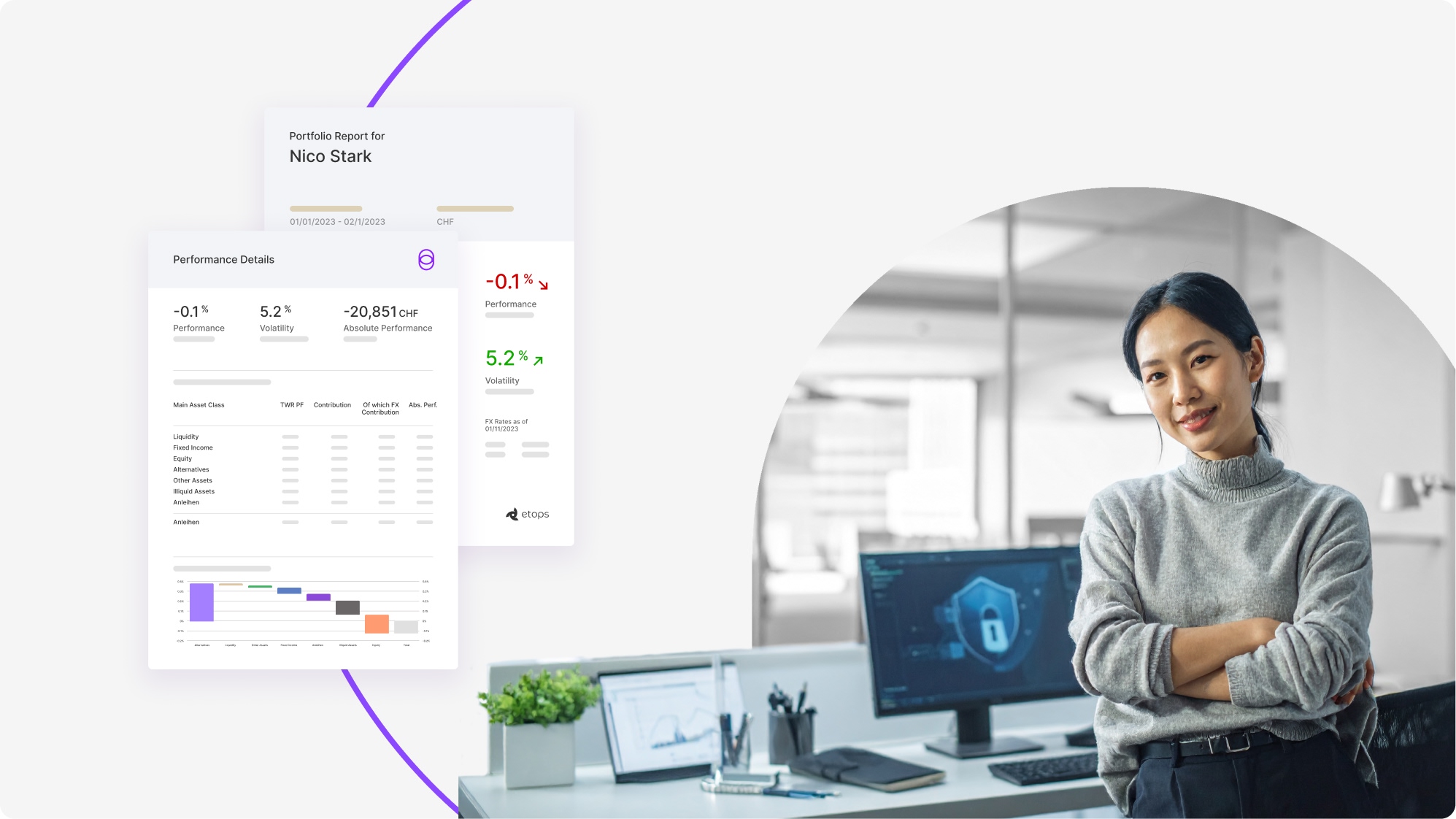

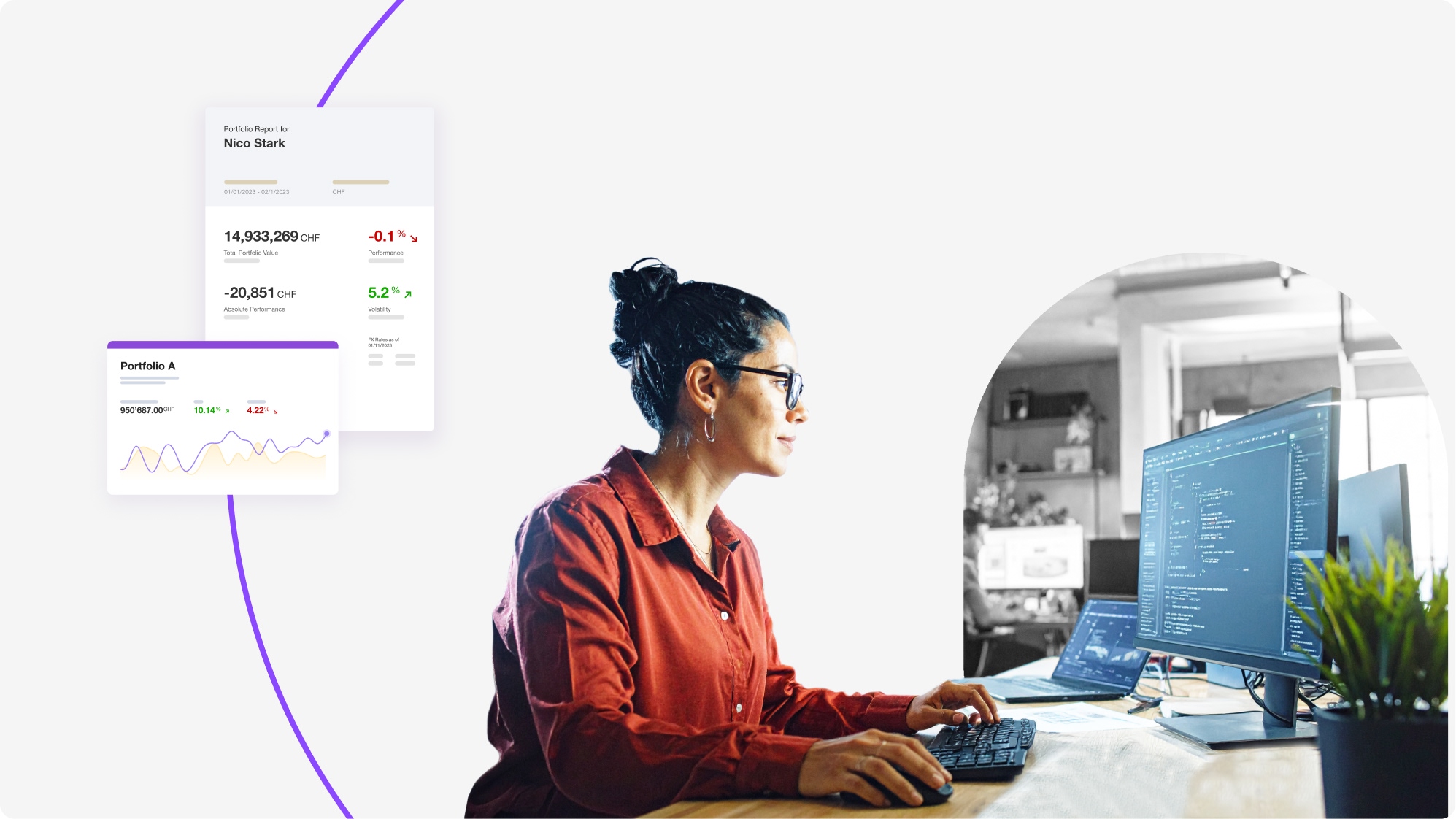

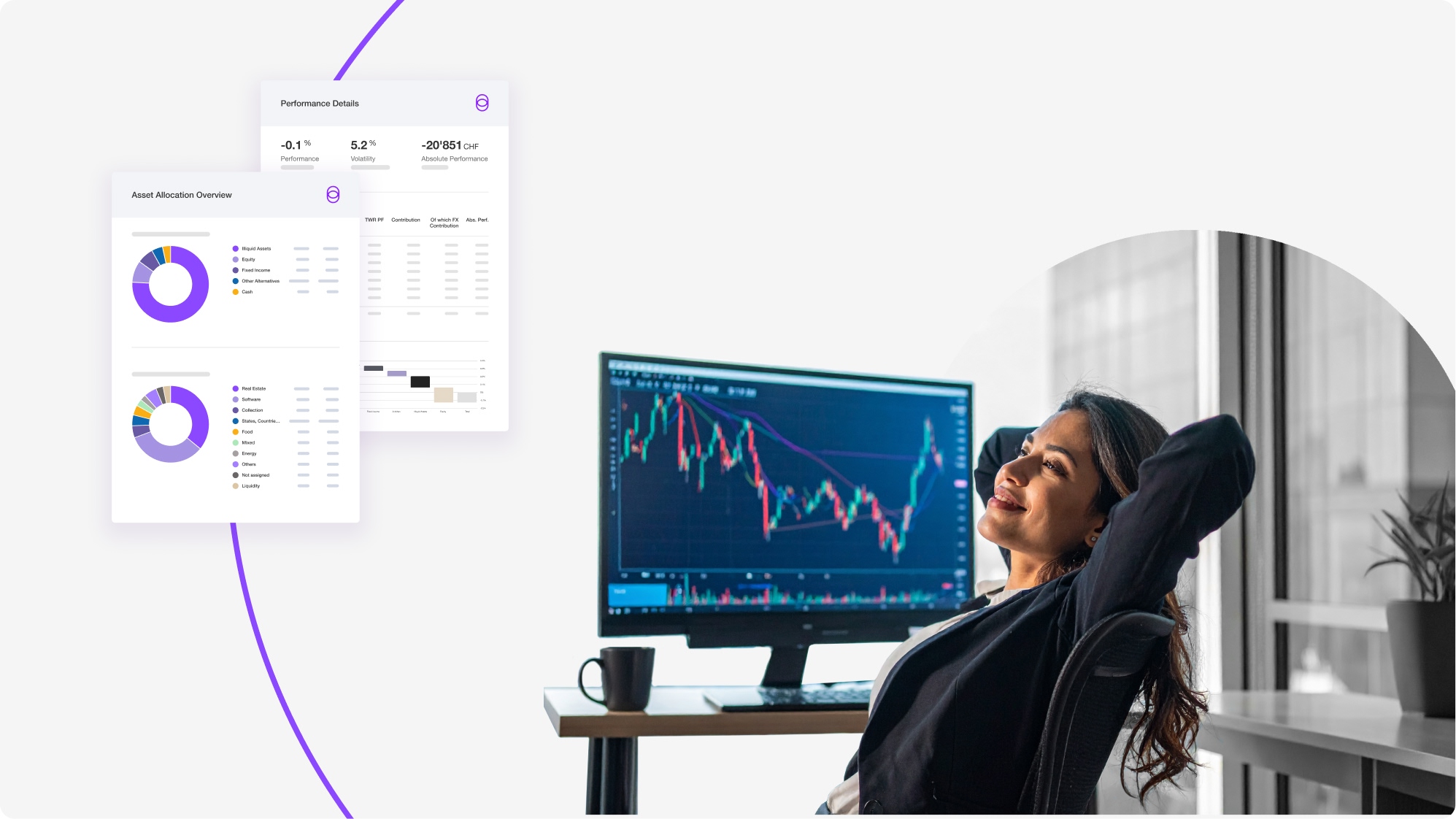

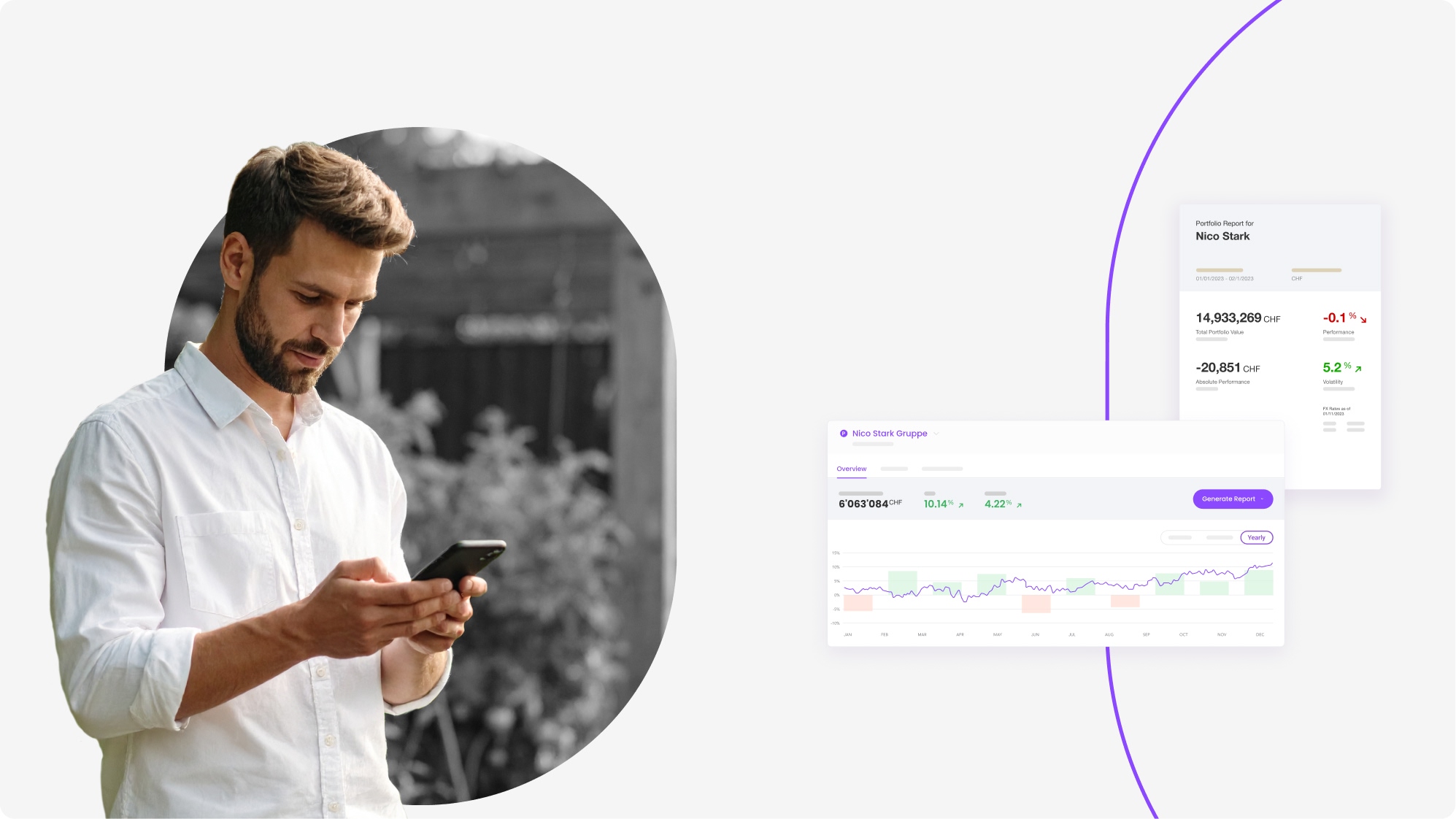

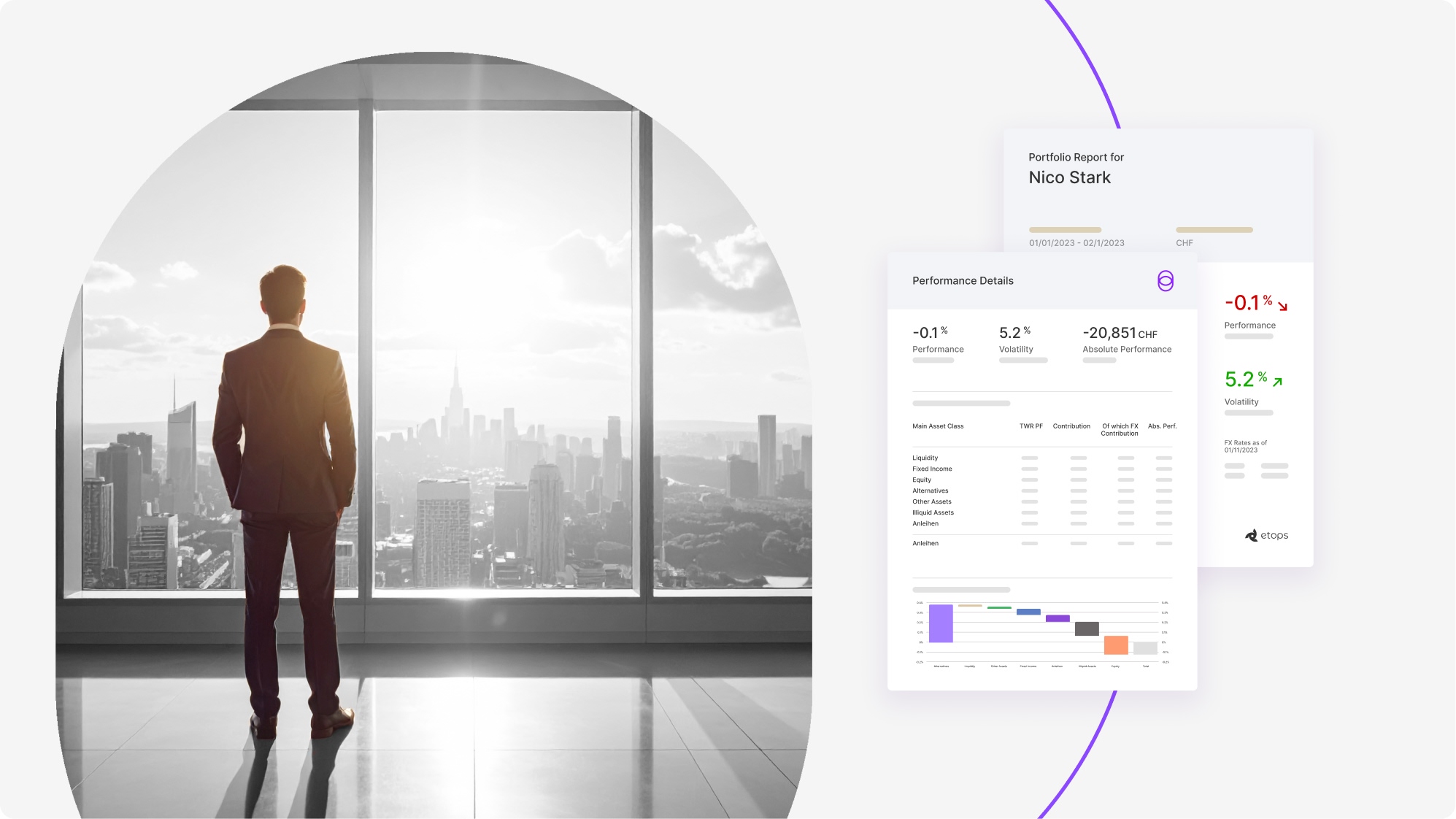

Product

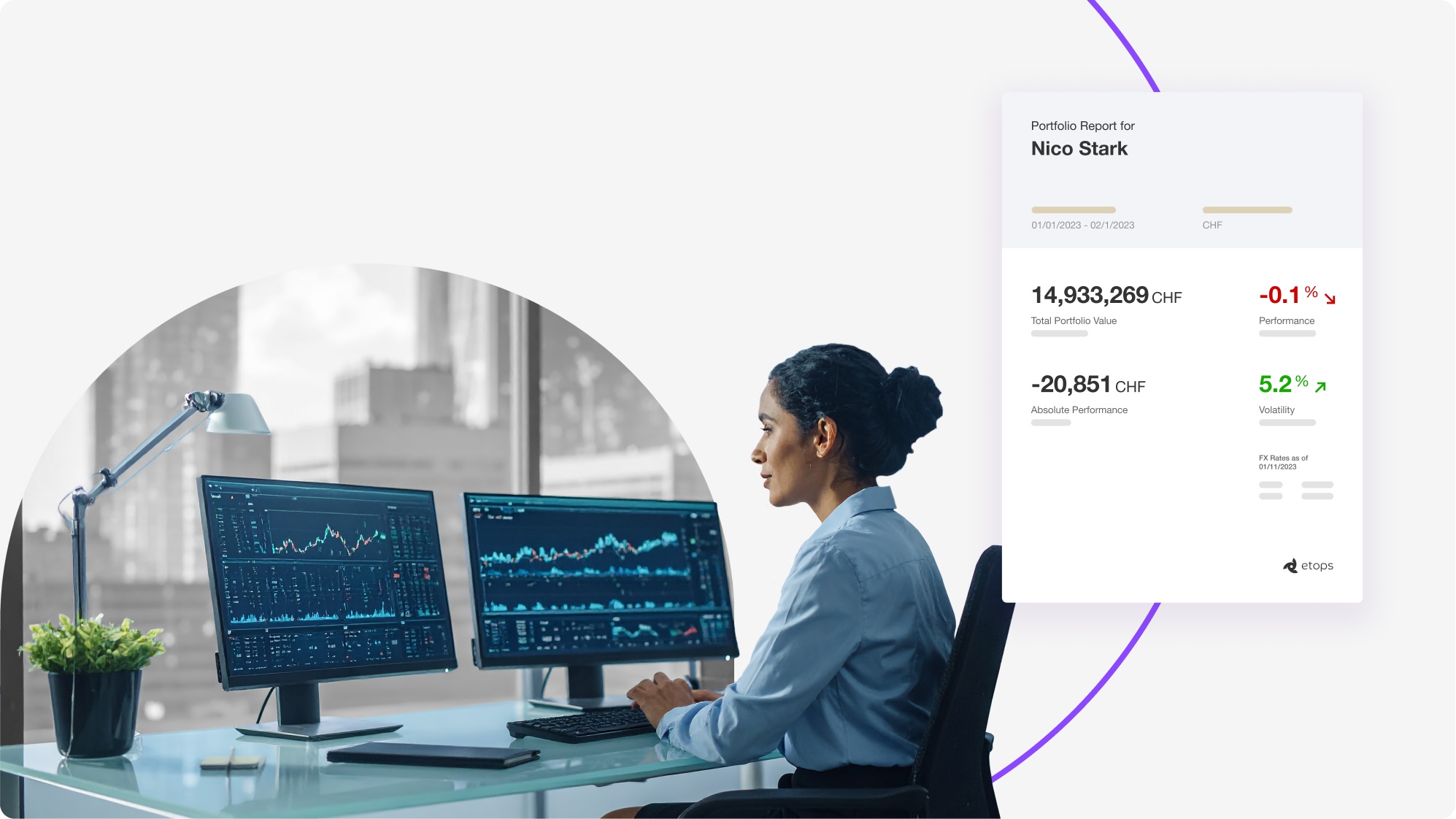

A Game-Changer in Wealth Management: Reporting with Etops Wealth Discovery

With its award-winning platform, Etops revolutionizes client reporting in wealth management. Offering unparalleled flexibility, visual appeal, and regulatory compliance, Etops enables wealth managers to create personalized, easy-to-understand reports tailored to each client's needs. Through intuitive...

Industry Insights

How AI changes wealth & asset management

In the field of wealth management, Etops is committed to innovation and keeping pace with the latest developments in tech and AI. We are dedicated to meeting the evolving needs of our clients and continually...

News